One theme of the last several years has been the rise in capital expenditures related to the artificial intelligence (AI) arms race. Nowhere has this been more visible or significant for financial markets than with the major US technology companies – Amazon, Google, Meta, and Microsoft – as these behemoths have steadily invested ahead of investor expectations. On top of exceeding expectations for spending and growth, the companies have consistently guided for higher spending than the market has expected, much to the benefit of key suppliers of everything ranging from semiconductors to the equipment needed to build datacenter capacity.

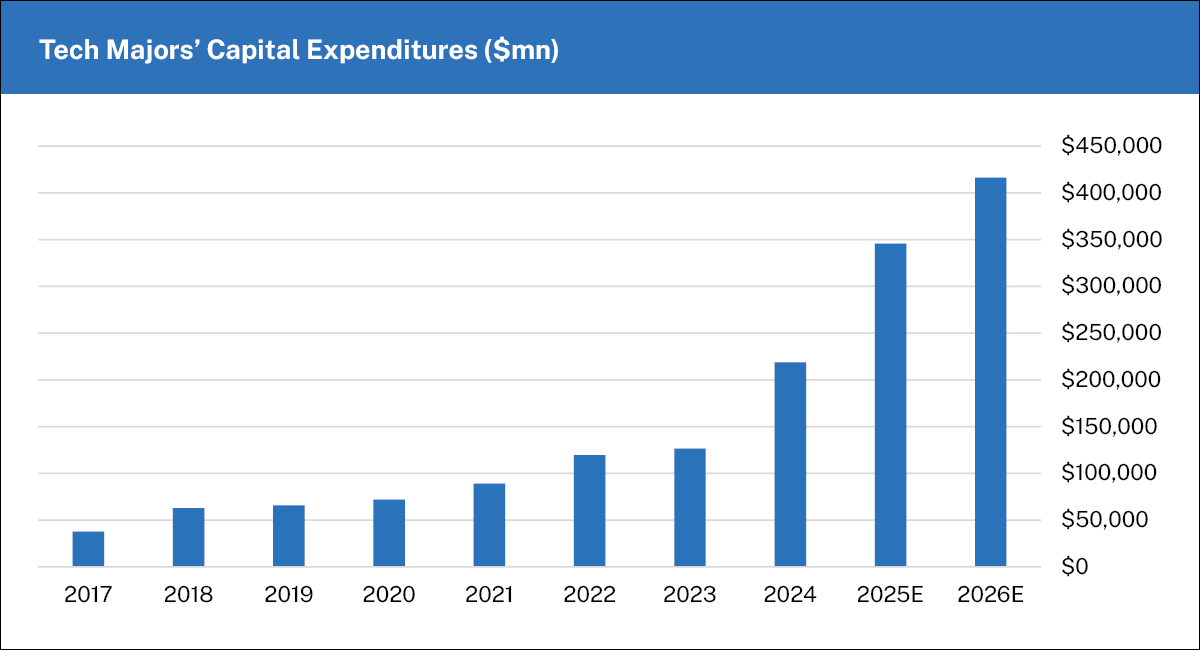

No matter how we cut it, the spending binge we’ve seen has been nothing short of incredible. From an absolute perspective, the four companies are on pace to spend approximately $350bn this year alone, a nearly 5x increase from 2020.

AWS, Google, Facebook, Microsoft

Analysis: Manning & Napier. Source: FactSet (2017 – 2026).

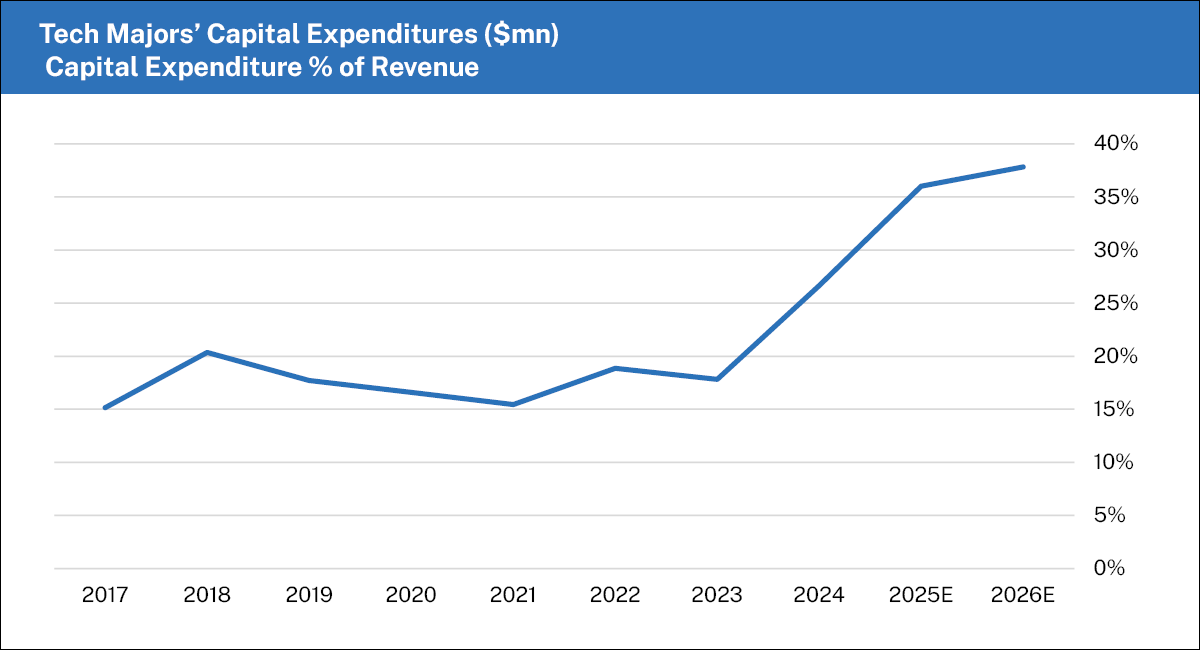

As a percentage of revenue, we are rapidly approaching 40%, up from just over 15% in 2020.

Analysis: Manning & Napier. Source: FactSet (2017 – 2026).

In thinking broadly about what has happened and what’s to come, there are several things that are true. For one, this is a capex binge the likes of which modern financial markets have rarely, if ever, seen. The impacts have been staggering, particularly for the semiconductor industry where Nvidia has reached a market capitalization over $4.5 trillion and the broader space has massively outperformed the S&P 500. Adjacent industries – providers of the equipment needed to construct new datacenters – have also been massive beneficiaries.

It is also the case that the massive investments have sparked intense debates about the endgame, like how these companies investing so heavily ultimately can monetize those investments in the future. For now, investors have accepted the idea that these investments will eventually be rewarded with breakthroughs that generate significant pools of revenue and improve returns. Increasing investment has generally not been punished by the market and has benefited the suppliers tremendously. This has not been without a cost, however, as investors have also punished parts of the market they believe are ripe for disruption by advances in AI.

One such part of the market that has recently felt the chill of the narrative shift in technology has been software. While optically the industry has held up well, this has been due in large part to the continued strength of Microsoft. Under the surface, we are seeing significant pain and extremes in relative valuation, flows, and positioning. It’s clear that a structural bear thesis has taken hold, as investors fear dynamics ranging from AI reducing the need for as many software developers, to falling barriers to entry in the space, to enterprises writing their software.

As it stands right now, we see no sign of slowdown in the AI investments from the technology majors. In such an environment, there is little reason to believe that a narrative shift that would relieve pressure on software companies is imminent. Yet it has always been the case that trees don’t grow to the sky, and at some point the current capex cycle will reach its end. When it does, the world will once again be reminded that the semiconductor industry is a highly cyclical one, and the hangover on the other side of the current spending binge could be a rough one. Consider the fact that since 2000, Nvidia has drawn down over 50% nearly ten times; since 2010, there have been four such drawdowns.

When that does inevitably happen, it’s also likely that the narrative driving current performance dynamics in markets will shift abruptly. We believe that this will be of tremendous benefit to investors with the patience and foresight to identify and capitalize on opportunities emerging in the market today.

At Manning & Napier, we have developed a strong differing perspective surrounding the impact of AI on software. We believe the ultimate impact is being severely overstated and view the adoption of AI as a net positive for many software companies. As referenced above, we are seeing companies with strong business models and high-value assets trading at incredibly attractive absolute and relative valuations.

It’s completely fair to point out that the narrative and real spending surrounding AI investments looks set to continue for now, and as such, shares of software companies could continue to feel pressure. Frankly, we would agree. But we also have a high degree of conviction that the market will ultimately come around to the view that these are not impaired assets and that there is a great deal of value housed in these companies. For this reason, we’re comfortable slowly scaling into positions while also making investments into beneficiaries of the ongoing spend on AI infrastructure.

As an active investment manager, we have both the scope and flexibility to take advantage of ongoing trends in the market while building positions in companies that we expect will be beneficiaries of a narrative shift that we believe is inevitable.

Enjoying this information? Sign up to have new insights delivered directly to your inbox.

This material contains the opinions of Manning & Napier Advisors, LLC, which are subject to change based on evolving market and economic conditions. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.